Fraud, everyone's business

Fraudsters use various schemes to try to extort confidential information and/or money.

For example, fraudsters impersonate identities (posing as organizations or companies) to try to obtain valuable information (your personal data) that allows them to hack into your accounts.

Fraudsters access your accounts, for example, if:

- you have a password that is too simple

- you have previously been a victim of phishing

- you have communicated your password without knowing it

- you have used the same password on several sites, one of which has been hacked

- a "password-stealing" virus is present on one of your devices (computer, tablet, etc.)

5 GOLDEN Rules to avoid falling into the trap of fraudsters!

- To access your Nickel Customer Area, only the Nickel App and the link app.nickel.eu are valid

- A Nickel advisor will never ask for your Customer Area login codes (username / access code and password)

- Never communicate your transaction validation codes to a third party (especially those received by SMS)

- Never validate an unknown operation (that you did not initiate) in your Nickel App

- Never give your card information: PIN / secret code, card number, security code on the back of the card

"Phishing" is a computer technique frequently used by fraudsters. Fraudsters contact you and invite you to log in to the personal/client area of a trusted entity (Ameli, bank, CAF, taxes, Netflix, etc.). Through this means, fraudsters take the opportunity to ask you for confidential information related to your bank account (logins and passwords linked to your account, card code, etc.) in order to have the means to access your account and then use it for their own benefit.

To do this, fraudsters do not hesitate to use, for example:

- the brand

- the logo

- the Nickel slogan

- the names of the founders

- the names of certain advisors

The channels used by fraudsters to contact you

- Sending fake emails

- Fraudulent phone calls ("vishing"): derived from the email phishing technique, fraudsters use voice (voice messages, phone calls) to try to collect personal information and defraud you.

- Sending fake SMS ("smishing"): derived from the email phishing technique, this is the sending of SMS containing a redirection link (to pay a fine, a package held at customs, etc.)

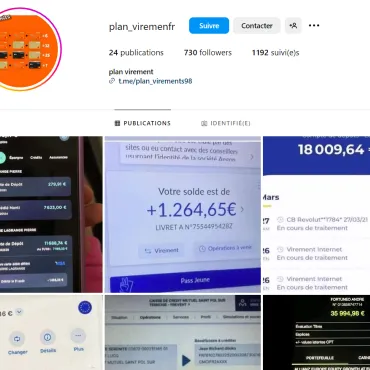

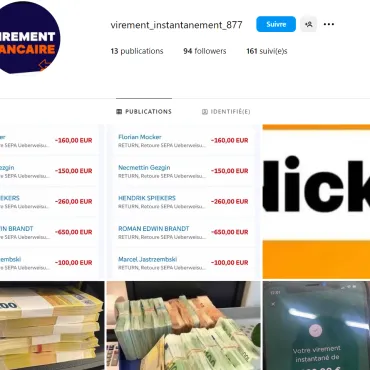

- Creating fake profiles on social networks (Twitter, Facebook, Instagram, LinkedIn, etc.)

- Creating fake websites

Fraudsters contact you from a seemingly reliable phone number. They attempt to impersonate a trusted person/organization to ask you for confidential information related to your bank account (logins and passwords linked to your account, card code, etc.) in order to gain access to it and then use it for their own profit.

Fraudulent offers of savings accounts or lucrative financial investments are numerous on the internet. To achieve this, fraudsters usurp the identity of banks and other financial institutions.

These investment offers seem too attractive, and some of these elements can alert you:

- A suspicious advisor: they have an aggressive approach and/or promise you an exclusive offer, not hesitating to play on the bargain effect.

- A link redirecting to a suspicious site (pay attention to the URL) or to download an application (only download applications from the App Store or Google Play Store).

- Unusual subscription forms for investment products.

- Spelling mistakes.

- A sense of urgency justified by an exclusive/unique offer.

- A transfer to a foreign bank account (RIB).

- Products with high returns, no risk, and whose funds are available in a few weeks.

Fraudsters approach you with the promise of quick earnings. They ask you to deposit sums into your bank account and then transfer them to them, in exchange for financial compensation (a commission).

For example, the fraudster approaches you on social media and asks you to cash a check or receive a transfer into your bank account.

They ask you to return a portion of the deposited amount within a very short timeframe via transfer, cash withdrawal, money order, or prepaid card.

However, the check bounces (because it has been canceled by the real check holder). This leaves you with a financial loss that benefits the fraudster. Worse, in the case of hosted transfers, the fraudster will not hesitate to completely empty your account.

Credit card fraud Credit card fraud is the fraudulent use of a person's credit card details without their knowledge.

To obtain the victim's credit card details, the fraudster can use a number of methods:

- Phishing through a message encouraging you to provide your details

- Hacking an online account where your credit card details are stored (online merchant site, streaming site, social networks, etc.)

- Hacking a computer device (computer, telephone, etc.)

- Use of a data leak from an online site where you have left your bank details

To be a victim of credit card fraud, the following conditions must be met:

- The credit card details must have been used to make online purchases

- You are not the originator of the debits

- The credit card is still in your possession

Watch our prevention videos:

Toolbox:

- To report a scam or fraud on the Internet and file a complaint, use the dedicated platform THESEE

- Check websites and sender email addresses on the Banque de France blacklist

- Report SMS and voice spam via the number 33700 (anti-spam platform)

- Secure your documents to be sent via the Filigrane platform

- Report your bank card fraud via the Perceval platform

- Assess the risk level of an investment on the AMF website

Contact us:

- Social networks: Nickel is present on Facebook, Instagram, and TikTok, identifiable by blue verification badges. Before communicating, check for the small blue badge next to the page name. ( Our guide here )

- By email/phone: To report any type of fraud seen on the internet, forward the email or a copy of the original page to the following address: fraudeur@compte-nickel.fr or contact Nickel Customer Service at 01 76 49 00 00.